Collaborators: Will Freudenheim, Darren Zhu

Support: Antikythera

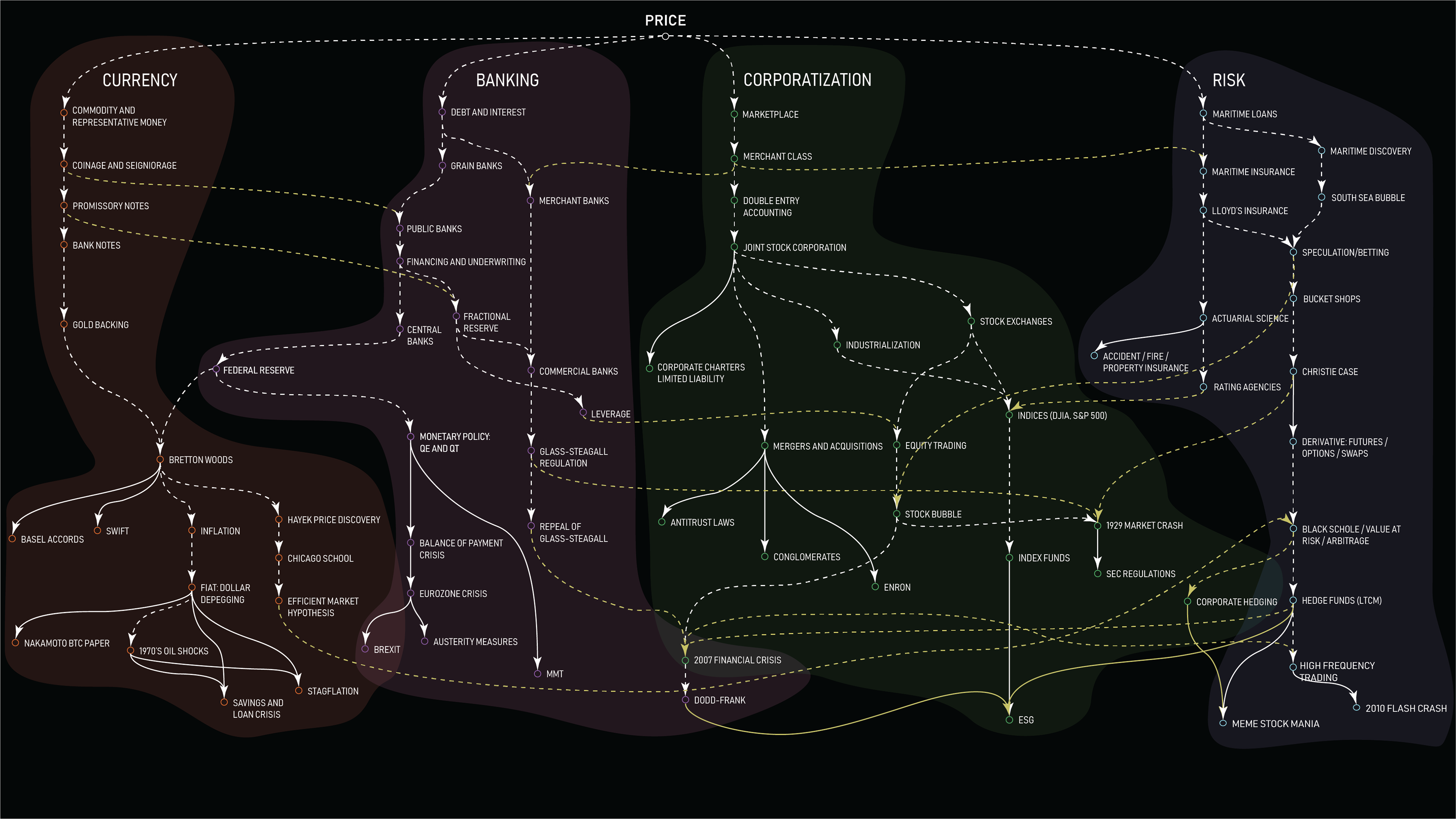

Price is not the number you see at the gas station. It’s what you don’t see: The sensation, integration, and compression of planetary scale information spread across crude oil prices, refinery markets, OPEC decisions, geopoliticking, distribution and marketing costs, taxes, and the financial instruments layered throughout the network.

Following Andrew Lo and the Sante Fe Institute, this project contends that on account of the adaptive capacities of price, economics ought not be understood through the lens of physics, but of evolutionary biology, hence price’s phylogeny. And, as price’s sensory integration techniques have evolved, so too have the type of economic systems that can be imagined. The economic systems we know–capitalism, mercantilism, socialism–are not causes, but symptoms of price’s evolving.

To date, price has evolved enormously complex sensory integration techniques, and as it faces new pressures–a Great Carbonization Event and an Informatic Complexity Threshold–its mutation rate is likely to accelerate. Today’s mega-risks are born of connection and complexity: pandemic, hemispherical tension, bank failure, energy insecurity, climate catastrophe, information balkanization–a polycrisis whose whole is greater than the sum of its parts. On the one hand, a new species of financial instrument may rise to fill the niche created as legacy systems go extinct. On the other hand, price will also select for the emerging technologies that bolster the adaptive capacities of the global system of exchange, for example the recent step change in the power of transformer models may lead to a hyper-hypo-pricing speciation that alleviates the so-called “rational inattention” of consumers.

What gives rise to these possibilities is the autocatalytic power of price, the question of autocatallaxy.